extended child tax credit portal

Here is some important information to understand about this years Child Tax Credit. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

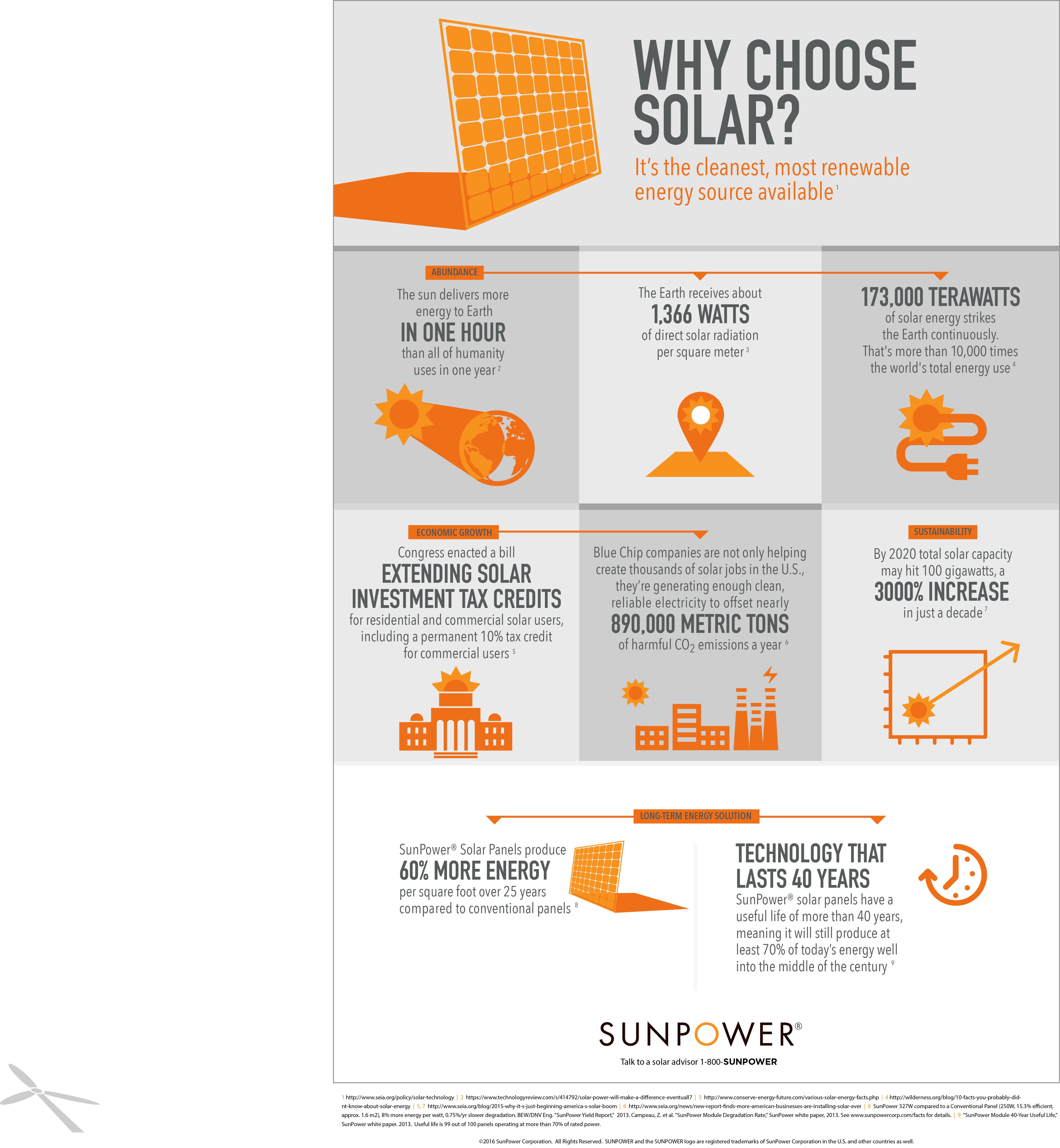

Infographic Cool Facts About How Solar Energy Works Sunpower Solar Blog

Prepare your 2021 Return on.

. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. Get your advance payments total and number of qualifying children in your online account. Child Tax Credit amounts will be different for each family.

The Child Tax Credit provides money to support American families. The credit includes children who turn age 17 in 2021. To reconcile advance payments on your 2021 return.

A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of. How To Change Your Direct Deposit Information on the Child Tax Credit Update Portal Checks in the amount of either 300 or 250 will be deposited. The agency intends to debut an online portal on July 1 to allow it to send the child tax credit to families periodically this year instead of as a lump sum at tax time Rettig said.

This will be half of the total amount paid out with the other half. The credit will be fully refundable. In the meantime the expanded child tax credit and advance monthly payments system have expired.

To be eligible for this rebate you must meet all of the following requirements. Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6. The thresholds for the new advance child tax credit are 150000 for married filing jointly 112500 for head of household and 75000 for individual taxpayers.

They have until April 15 2025 to do so. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Your amount changes based on your income. For children under age 6.

The payment for children. The advance Child Tax Credit or AdvCTC as part of the American Rescue Plan Act is a refundable tax credit. A childs age determines the amount.

3000 For children under 6. The enhanced child tax. Democrats are reportedly drafting legislation to expand the child tax credit from 2000 to 3000 or 3600 depending on the childs age and the familys income.

Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Enter your information on Schedule 8812 Form 1040.

2000 For children 6 through 17. The credit was made fully refundable. The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18.

The advance Child Tax Credit or CTC payments began in July 2021 and end by 2022. An online portal designed to help very low-income people get the expanded Child Tax Credit reopened Wednesday according to the nonprofit group that. Credit is now fully refundable.

Max refund is guaranteed and 100 accurate. Of that group anyone who claimed dependents aged 17 and younger as of the end of the end of the 2020 tax year and who tallied equal to or less than 75000 single tax filers 112500 heads. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. From the enhanced child tax credit to universal pre-K Build Back Better makes historic investments to help parents VIDEO 827 0827 How a 31-year-old US.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The IRS has now processed the sixth December and final round of advance 2021 monthly payments for the expanded Child Tax Credit CTC to parents and guardians with eligible dependents. Qualifying parents wouldnt have.

Child Tax Credit Update Portal. This tax credit is changed. To reconcile advance payments on your 2021 return.

Your amount changes based on the age of your children. 4 1 Amount increase 0 500 1000 1500 2000 2500 3000 3500 Previous Child Tax Credit. It is an advanced payment of a tax credit you would qualify for on your 2021 tax return due in 2022.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. After that families can still claim the 2021 CTC but will need to file full tax returns. Free means free and IRS e-file is included.

The advance payments accounted for 50 of the credit you were due with the remainder and any adjustments to be claimed via your 2021 tax. But taxpayers whose incomes are a. By Toby Eckert.

The fourth installment of this years Advance Child Tax Credit is set to hit bank accounts today Fri Oct. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. For 2022 that amount reverted to 2000 per child dependent 16 and younger.

3600 17-year-olds eligible for the first time. The Child Tax Credit was expanded under the Key Ways American Rescue Plan in FOUR key ways. Parents income matters too.

You must be a resident of Connecticut. See below for more information. The credit amount was increased for 2021.

Democrats beefed up the child tax credit to a maximum of 3600 for each child up to age 6 and 3000 for each one ages 6 through 17 as part of the American. Havent Received a Child Tax Credit PaymentCheck if Youre Eligible Find. Bigger child tax credit for 2021.

05112022 0129 PM EDT. You must have claimed at least one child as a dependent on your 2021 federal income tax return who was 18 years of age. By making the Child Tax Credit fully refundable low- income households will be.

For children under 6 the amount jumped to 3600. To learn more about key outreach dates in the coming months check out this blog.

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Cbic Issues Notices To Companies For Itc Refund With Interest Indirect Tax Company Data Analytics

Gstr 9c Due Date For Annual Return Form 2020 21 Ca Portal Dating Form Due Date

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Super Cool Taxtips To Help You Win Taxes Visit Https Tax2win In File Your Return For Free Itr1 Itr Taxtips Tax2win Hap Tax Credits Tax 2 More Days

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Electronic Gst Refund Portal Refund Electronics Department

Itba Conversion Of Case From Limited To Complete Scrutiny Reg

Deadline For Filing Form Gst Tran 1 Extended To 31st March 2020 Indirect Tax Data Analytics Filing Taxes

How To Know Gst Registration Number From Tin Number

If You Are Still Struggling With Gst Return Mismatches Then Hostbooks Gst Is Right Here To Help You Out We Billing Software Accounting Software Payroll Taxes

Infographic Cool Facts About How Solar Energy Works Sunpower Solar Blog

7 Day Extension At Last Moment What A Shame Cbdt Has Extended Due Date For Filing Itrs Tax Audit Reports Under Income Income Tax Return Income Tax Due Date

Parents Guide To The Child Tax Credit Nextadvisor With Time

194ib Tds On Rent W E F 01 06 2017 By Individuals And Hufs

Outsourced Accounting Services

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet